Individual and Group Long-Term Disability Insurance Companies Play Games With Your Claims

If you’re one of many fortunate Americans, you have paid for your own individual long-term disability coverage, or you have a policy provided by your employer. Having an individual or group long-term disability policy in place gives some much-needed peace of mind—if something happens and you can no longer perform the important duties of your occupation, you can sleep at night knowing that your family’s financial future is secure.

Unfortunately, many Americans discover that it’s not so simple. Filing a claim with your individual or group long-term disability insurer is not an easy process. To make matters worse, insurance companies employ a number of tactics to create confusion, delay decisions, and ultimately deny or terminate legitimate claims. Meanwhile, you’re out of work and the bills are piling up. The long-term disability policy that seemed like a wise investment now isn’t worth the paper it’s printed on.

That’s when it’s time to call DarrasLaw. We know the games that individual and group long-term disability insurance companies play when handling your claim. DarrasLaw’s top-rated disability attorneys and award-winning ERISA lawyers also know how to fight back—and we win.

Demanding Impossible Proof

In some cases, it’s easy to establish that the claimant has suffered either a permanent or long-term disability. For example, someone who sustains a spinal injury and is confined to a hospital bed for several months obviously can’t perform the important duties of his occupation.

What if you suffer from chronic, debilitating pain? What if you’re not completely disabled, but your injury or illness makes it impossible to perform the important duties of your occupation with reasonable continuity and in the usual and customary way? There is no simple blood test for pain. You can’t prove that many chronic conditions exist with an X-ray or MRI.

This doesn’t stop many individual and group long-term disability insurance companies from demanding documented objective proof that a disabling condition exists. In other words, it takes the position that the condition is a figment of your imagination until you provide compelling medical evidence and proof to the contrary.

Of course, individual and group long-term disability insurance companies don’t say this outright. Instead, they engage in tactics designed to make it easy for them to deny your claim. Here are some common examples of the lengths they will go to:

- More and more demands for duplicative documentation or revised documents, requiring multiple visits to your doctor

- Multiple, repetitive phone interviews with you

- Requiring in-person interviews

- Covert surveillance

- Requiring that you submit to an “independent” medical examination conducted by someone other than your primary care physician—oftentimes a doctor without the medical training or specialization to properly evaluate your condition

The point of these unreasonable claim tactics is to build a file that your individual or group long-term disability insurance company can use to argue that your condition does not impair you and that you are therefore not disabled.

Hiding or Ignoring Evidence That Supports Your Claim

Some insurance companies have been caught ignoring evidence that would support a claim for long-term disability benefits. You may have submitted this evidence to your individual or group long-term disability insurance company, but it may also have dismissed evidence their own investigators compiled. For example, let’s say that you submitted to an “independent” medical exam, and the doctor’s report indicates that your symptoms support your disability claim. The insurance company may have ignored that report and manufactured other reasons to deny the claim.

Terminating a Previously Approved Claim

Again, it may seem hard to believe, but we’ve seen many, many cases where individual or group long-term disability insurance companies have tried to terminate a claim that they previously approved. In some cases, the insurance company paid disability benefits for years, and then suddenly decided that the person was no longer disabled.

This is sometimes due to an internal change in the company’s claim personnel. Maybe it decided that it is paying out too much in claims and that is harming the financial health of the company. In other cases, we believe this is the insurance company’s strategy from the outset. They wait until people believe they are secure in their claims, and then compile evidence to support termination of the benefit. For example:

- It may notice that you have not kept up with regular visits to your treating physician.

- It may hire a private investigator to follow you with video surveillance.

- It may subject you to further interviews.

Each step of the way, insurance companies are trying to find inconsistencies that help them prove that you’re not disabled and that you are able to return to work.

Delay, Delay, Delay

Many insurance companies attempt to use the deadlines in the claim process to their advantage. They do this for two reasons: (1) it gives them more time to build their case, and (2) it can also make it harder for claimants to offer rebuttal evidence or provide further documentation. Some companies have even been caught backdating claim documents. Be sure to carefully track all dates and deadlines, and keep the actual envelopes that the insurance company sends you, as you may need the postmark to prove the date it was actually sent to you.

Countermeasures

At this point, you may feel worried about obtaining your long-term individual or group disability benefits, and rightfully so. Unfortunately, you’re going to have to go through the claim process if you’re going to receive your disability benefits. Here are some suggestions to help you keep your balance while walking the claim process tightrope:

- Remember that your individual or group long-term disability insurance company is not on your side, even if it says it is. It wants to avoid paying claims and protect the financial health of the company for the benefit of shareholders.

- Take care in what you post on social media. Your individual or group long-term disability insurance company may use a seemingly harmless picture while on vacation against you when denying or terminating a claim.

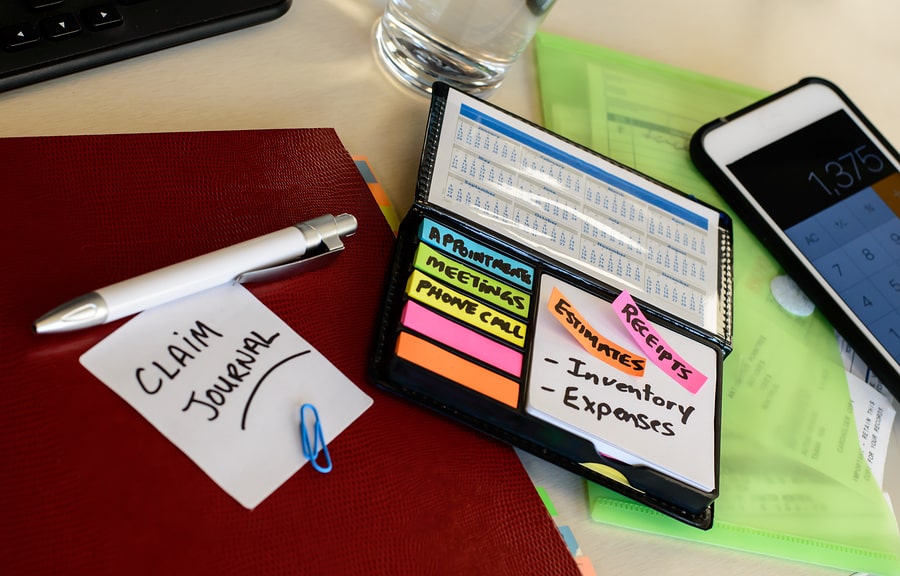

- Take careful notes and keep copies of everything. Document whom you spoke to, when you spoke to them, and what you discussed. Never give your only copy of a document to your insurance company. As noted above, keep close track of all dates and deadlines.

Contact a Top-Rated Long-Term Disability Attorney or Award-Winning ERISA Lawyer at DarrasLaw for Help

Without a doubt, the claim process is a minefield designed to keep you from obtaining the benefits you are entitled to. Regardless of where you are in the process, the experienced long-term disability attorneys and stellar ERISA lawyers at DarrasLaw can help you get your rightful benefits so that you can focus on your health. Our nationally recognized, award-winning litigation firm knows how to fight individual and group long-term disability insurance companies and, more importantly, we win. To schedule a completely free policy analysis and free claim consultation, call DarrasLaw at 800-898-7299 or contact us online.