Three Long-Term Care Facts Everyone Should Know

No one likes to think about what will happen to them as they age. However, as uncomfortable as the topic is, Americans desperately need to plan for the future and assess their potential long-term care needs.

In honor of Long-Term Care Insurance Awareness Month, here are key facts about long-term care that everyone needs to consider, regardless of age.

1. You have a greater chance of needing long-term care than you think.

According to the U.S. Department of Health and Human Services, 70 percent of people who reach age 65 will need LTC services at some point in their lives. This means two in three adults will require some form of help in activities like bathing, eating, toileting, dressing, walking and transferring.

However, Lincoln Financial Group’s 2016 Long-Term Care Awareness Study reveals that the majority of people approaching retirement or in retirement have not taken any action to prepare for an “unanticipated long-term care event.”

The study, conducted by Zeldis Research, surveyed 500 people between the ages of 40 and 70. Of those surveyed, only 45% of respondents with a financial adviser have discussed the costs of long-term care with the adviser.

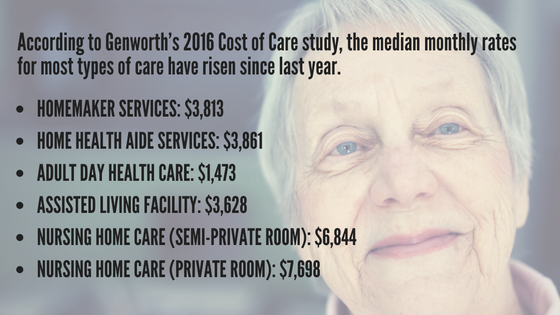

2. Long-term care costs are rising, and most Americans cannot afford them.

Unfortunately, most Americans do not have this kind of money lying around. Nearly half of U.S. households would have trouble meeting emergency expenses of just $400.

When their savings run out, many Americans rely on their family, Medicaid, or both to pay for long-term care expenses. However, there are many hidden costs to family caregivers, such as:

- Lost wages if they have to reduce hours or give up a job

- Stress and illness caused by the strain of caregiving

- Inadequate levels of care due to inexperience

Furthermore, many people do not realize that Medicare does not pay for non-skilled assistance with the Activities of Daily Living, which make up the majority of long-term care services.

Traditional long-term care insurance can to cover comprehensive long-term care costs that health insurance, Medicare and Medicaid do not. The cost depends on a number of factors, including your age, health status, and the optional benefits you choose.

3. Traditional long-term care insurance isn’t for everyone.

Despite the widespread need for long-term care, sales of traditional LTC insurance policies fell 60 percent over the past 10 years, according to the American Association for Long-Term Care Insurance. On average, LTC premiums rose 44.5 percent over the same period.

However, for those who still want some form of insurance, there are alternatives to the traditional long-term care insurance policy. For example, many people are turning to hybrid insurance policies that combines some benefits of long-term care insurance with those of life insurance.

Learn more about the how hybrid insurance options work and how they can be used to cover long-term care needs.

Remember, insurance companies are known to increase the premiums on policies, particularly when long-term care is involved. Make sure to study an insurance company’s premium rate history before purchasing a policy. Learn more about the steps to help make long-term care insurance more affordable despite rising costs.

Many experts recommend relying on multiple sources to fund long-term care needs. This is generally a combination of insurance, personal savings, and Medicare, Medicaid, and other government programs.